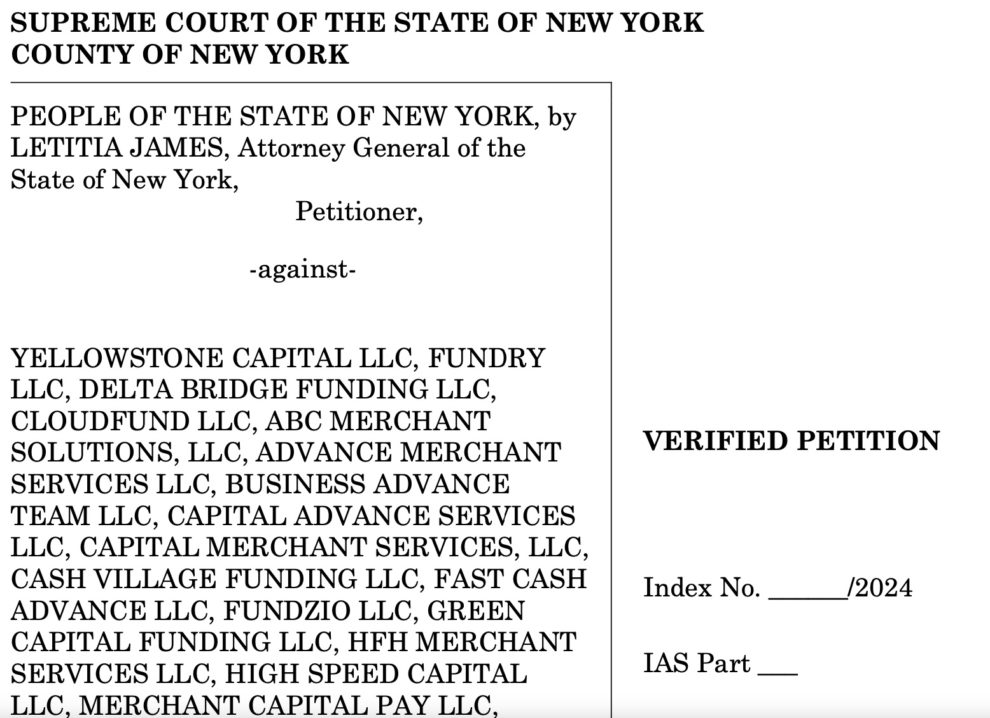

New York Attorney General, Letitia James, has filed a lawsuit against a large-scale illegal lending operation targeting small businesses on Long Island. The lawsuit was against a network of more than 30 individuals and other companies such as Yellowstone Capital, its founder, David Glass, Delta Bridge Funding, and other individuals who serviced and negotiated illegal loans.

The Office of the Attorney General, in this lawsuit, is seeking a minimum of $1.4 billion in fraudulent fees including the interest paid by small businesses, and a court injunction for the network to stop these illegal activities.

Before filing the lawsuit, AG James had already agreed on settlements with five individuals involved with the operation, which included about $3.37 million for affected small businesses and a prohibition from the merchant cash advance industry.

Highlights of the Case

According to AG James, Delta Bridge, Yellowstone Capital, and others pretended to help businesses but instead offered illegal, exceptionally high-interest loans. He alleges that Yellowstone Capital and others operated the fraudulent operation through a chain of different company names, including Green Capital Funding, Fundry, Capital Advance Services, and High-Speed Capital. AG James further revealed that following the investigations by the Office of the Attorney General and other government bodies, Yellowstone had stopped all operations.

However, the Office of the Attorney General investigation discovered that Yellowstone only rebranded as Delta Bridge, also called Cloudfund, and continued to offer the same illegal, fraudulent loans, charging exorbitant interest rates as high as 820%. The loan company allegedly misrepresented the loan terms and deceived business owners about the actual cost of the loans. Instead of the promised flexible repayment options, Yellowstone Capital reportedly debited fixed sums from their victims’ business bank accounts over short periods, thereby crippling cash flow and preventing repayment ability.

The Attorney General’s office is seeking $1.4 billion in restitution for impacted businesses and aims to stop the defendants’ illegal fraudulent operations to prevent them from preying on other borrowers. This lawsuit sends a strong message to other predatory lenders and highlights the Attorney General’s commitment to protecting businesses in New York. AG James encourages businesses in need of financing to thoroughly research loan terms and be cautious when entering a financing agreement.

The prosecution is being handled by Assistant Attorneys General Adam J. Riff, Dami Obaro, John P. Figura, and Attorney General Fellow, Emily E. Smith. The prosecution is under the supervision of Deputy Bureau Chief, Laura J. Levine and Bureau Chief, Jane M. Azia. Other officers that supported the investigation include all Bureau of Consumer Frauds & Protection members, Data Scientist, Jasmine McAllister, and Data Analyst, Black Rubey, under the supervision of Acting Director of Research & Analytics Gautam Sisodia.